Stay on Top of Tax Requirements

Ensure you are meeting any Federal, State, or Local tax requirements for your business.

Stay on Top of Tax Requirements

What taxes apply to my business?

Your business will need to meet federal, state, and local tax requirements. These requirements will depend on your business structure and location.

What are my local tax obligations?

Golden is a Home Rule City, meaning licensing and tax structures may differ from the State of Colorado or other areas. Consider the following taxation responsibilities in the City of Golden and visit this webpage for more detailed information.

- Building Use Tax - Construction Materials / Permits

- Lodging Tax - 6% on overnight commercial stays

- Sales & Use Tax - rates* below

SALES TAX

- City of Golden 3.0%

- State of Colorado 4.0%

- Jefferson County 0.5%

- Combined Rate 7.5%

USE TAX

- City of Golden 3.0%

- State of Colorado 4.0%

- Combined Rate 7.0%

Note: All payments of City tax should be made directly to the City of Golden. State and County taxes are collected by the State of Colorado. For additional guidance, please contact the City of Golden or consult a tax professional. *Rates as of January 2024.

What are my state tax obligations?

Various state tax obligations apply to different kinds of businesses. You can learn more about these obligations from the Colorado Department of Revenue.

What are my federal tax obligations?

Your business structure determines what federal taxes you must pay and how you pay them. Some of the taxes require payment throughout the year, so it’s important to know your tax obligations before the end of your tax year. There are five general types of business taxes:

- Income tax

- Self-employment tax

- Estimated tax

- Employer tax

- Excise tax

Each category of business tax might have special rules, qualifications, or IRS forms you need to file. Check with the IRS to see which business taxes apply to you. If your business has employees, you might be required to withhold taxes from their paychecks. Federal employment taxes include income, Social Security and Medicare, unemployment, and self-employment taxes. Check with the IRS to see which taxes you need to withhold.

Information for Remote Sellers

What is a Remote Seller?

A remote seller is a retailer without a physical location in Colorado but has established a presence by making retail sales in Golden, CO. Remote sellers typically make sales via online, mail order, telephone, etc.

Why do I need to submit a Remote Seller Information Form?

The City adopted Ordinance 2139 with the intent to address tax administration for retailers without physical presence in Colorado for all sales made in the marketplace.

How do I submit the Remote Seller Information Form?

Here are step-by-step instructions for obtaining a Sales & Use Tax License in Golden, Colorado:

- Determine if your business has established Economic Nexus according to the ordinance and is required to submit the form. Call 303-384-8024 with questions related to Remote Sellers.

- Submit the Remote Seller Information Form.

- Check with the Finance Department - Sales Tax Division when you apply to understand your taxation/renewal requirements.

Lodging Tax

Businesses providing accommodation must collect and remit municipal lodging tax for the City of Golden, Colorado.

- 6% lodging tax on the purchase price of lodging services in Golden, effective January 1, 2022.

- This tax applies in addition to any other sales taxes on lodging. It must be collected from customers by lodging service providers/retailers at the time of sale.

- Exemptions are provided for lodging purchased by government entities and certain nonprofit organizations.

- Administration, definitions, taxpayer responsibilities, and enforcement procedures will generally follow the existing Municipal Code Chapter 3.10.

New Federal Reporting Requirement for Beneficial Ownership Information (BOI)

What is BOI?

BOI stands for Beneficial Ownership Information. It's a new federal reporting requirement that became effective on January 1, 2024. Many companies doing business in the United States must report information about their beneficial owners (individuals who ultimately own or control the company) to the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Department of the Treasury.

Why does it exist?

The Beneficial Ownership Information reporting requirement was established by the Corporate Transparency Act, enacted by Congress in 2021. The purpose of this bipartisan law is to curb illicit finance. By requiring companies to report information about their beneficial owners, the government aims to increase transparency and combat financial crimes.

How do file if BOI requirements apply to me?

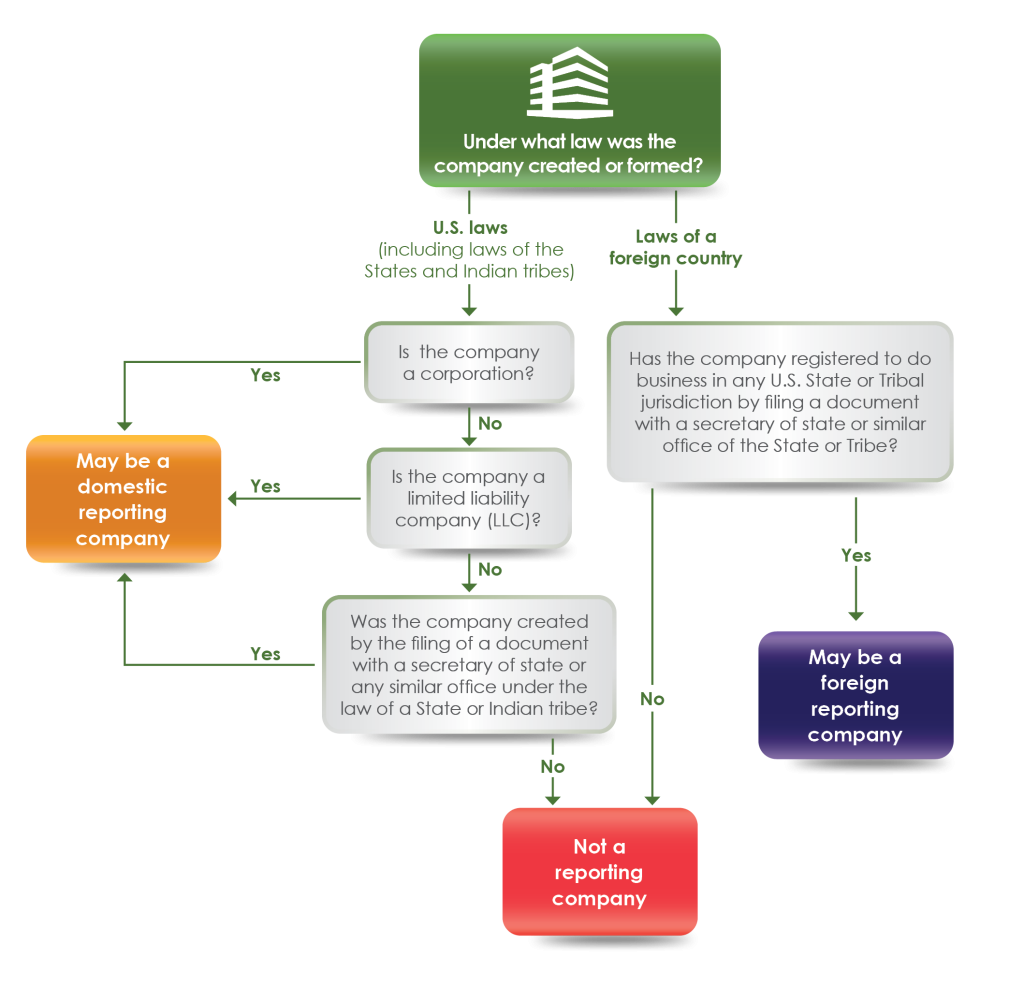

First, use this flowchart to determine if the filing requirement applies to you:

Note: there are 23 types of entities exempt from this requirement, including publicly traded companies, nonprofits, and certain large operating companies.

If BOI reporting applies to your company, you must register online on the FinCEN BOI Homepage:

- By January 1, 2025, for companies created or registered before January 1, 2024

- Within 90 calendar days of creation/registration for companies created/registered in 2024

- Within 30 calendar days of creation/registration for companies created/registered on or after January 1, 2025

The filing process is simple, secure, and free of charge. It's not an annual requirement, but updates or corrections must be submitted within 30 days of any changes.

.png)